Table of Contents

Cash a Check Online

Cashing a check online refers to the process of depositing or converting a paper check into digital funds. You can do it through an online or mobile platform. The process involves using a smartphone or computer to capture an image of the check and then submitting it electronically to a bank or financial institution for processing.

In this article from xpasx, we will cover all there is to know about cashing a check online.

Here's what cashing a check online generally entails:

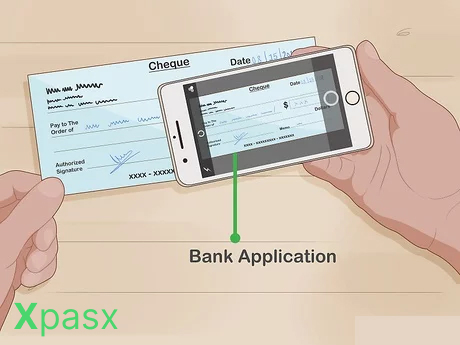

Capturing an Image of the Check: To deposit a check, use your smartphone or tablet’s camera to take a clear picture of both the front and back of the check.

Submitting the Check: After capturing the images, you can send them through a mobile banking app, a payment app, or another online service to be processed for deposit.

Verification and Processing: Once the images are submitted, the institution will verify the check’s validity and process it for deposit into your account. This process can take anywhere from a few minutes to a few days, depending on the service and any security checks.

Accessing the Funds: Once the check is processed and cleared, the funds become available in your bank account or digital wallet, and you can use them for payments, transfers, or withdrawals.

Cashing a check online provides a convenient and flexible option. It allows you to deposit checks without having to visit a bank or ATM, and provides quicker access to your funds in many cases.

Things you should consider before cashing a check online

Cashing a check online is a convenient way to deposit funds without having to visit a bank in person. However, there are some important things to consider to ensure that the process goes smoothly and securely.

First and foremost, it’s important to consider the legitimacy of the online platform you’re using. You must choose a reputable service, whether it’s your bank’s mobile app, a digital payment app, or a third-party check-cashing service. look for reviews, check their security features, and make sure they are licensed and regulated to handle financial transactions.

Next, consider the fees and processing times associated with cashing a check online. Some online platforms charge a fee for their services, which can vary depending on the type of check, the amount, and how quickly you want access to your funds. Review the terms and conditions to understand what fees might apply and how long it will take for the check to clear and the funds to become available. This information will help you avoid unexpected costs and manage your cash flow effectively.

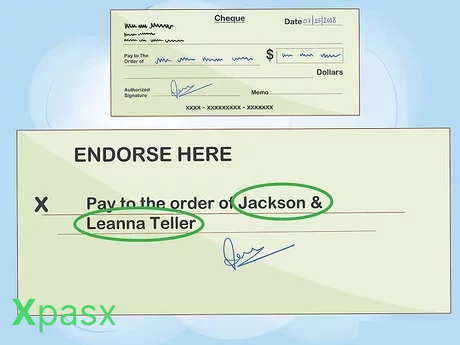

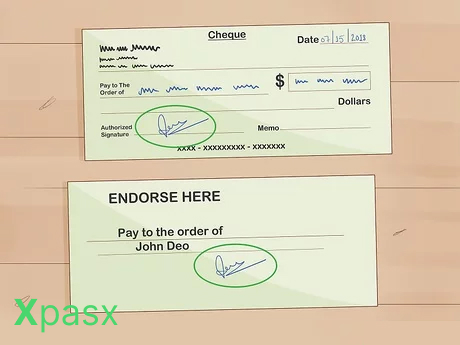

Finally, ensure that you have the necessary technology and information to complete the process. Cashing a check online typically requires a smartphone or tablet with a working camera, a stable internet connection, and a compatible app or website. You’ll also need to endorse the back of the check and sometimes write specific instructions as required by the platform. Double-check these requirements to avoid delays or rejections when submitting your check online.

By considering these factors, you can ensure that cashing a check online is a safe, efficient, and cost-effective solution for you.

Bottom Line

Cashing a check online means depositing funds without physically visiting a bank. To do this safely and efficiently, there are several key considerations you should be aware of.

Firstly, make sure that the platform you use to cash a check online is reputable. You can use your bank’s mobile app, a digital payment app, or a third-party check-cashing service. You must check for reviews, verify their security features, and ensure its safety.

Secondly, consider the fees and processing times associated with cashing a check online. Fees can vary depending on the type of check, the amount, and how quickly you want to access the funds. Additionally, processing times can differ, with some platforms offering instant access for a higher fee, while others may take a day or more to clear the check. Understanding these details will help you avoid unexpected costs and manage your finances effectively.

Lastly, make sure you have the necessary technology and meet the platform’s requirements for cashing a check online. You’ll generally need a smartphone or tablet with a working camera, a stable internet connection, and a compatible app or website. You must also endorse the check properly, and some platforms may require additional instructions. Double-checking these details helps ensure a smooth online check-cashing experience.

- If you wish to learn more, visit our page on cash.